UAE business community hails Pakistan’s pro-growth budget

Shaukat Tarin presents the annual budget as Prime Minister Imran Khan (left) attends the session at the National Assembly in Islamabad. AFP

Inayat-ur-Rahman, Business Editor

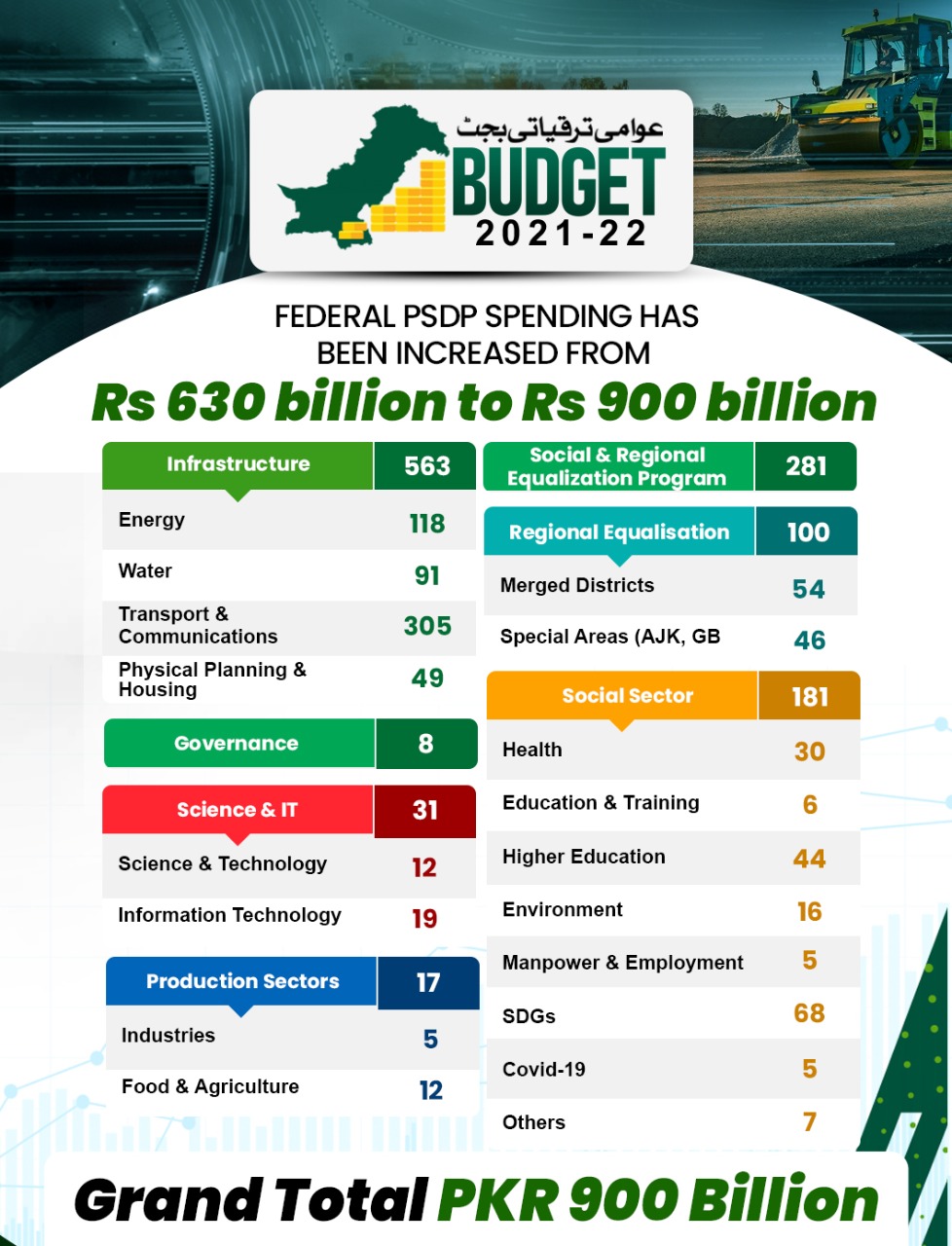

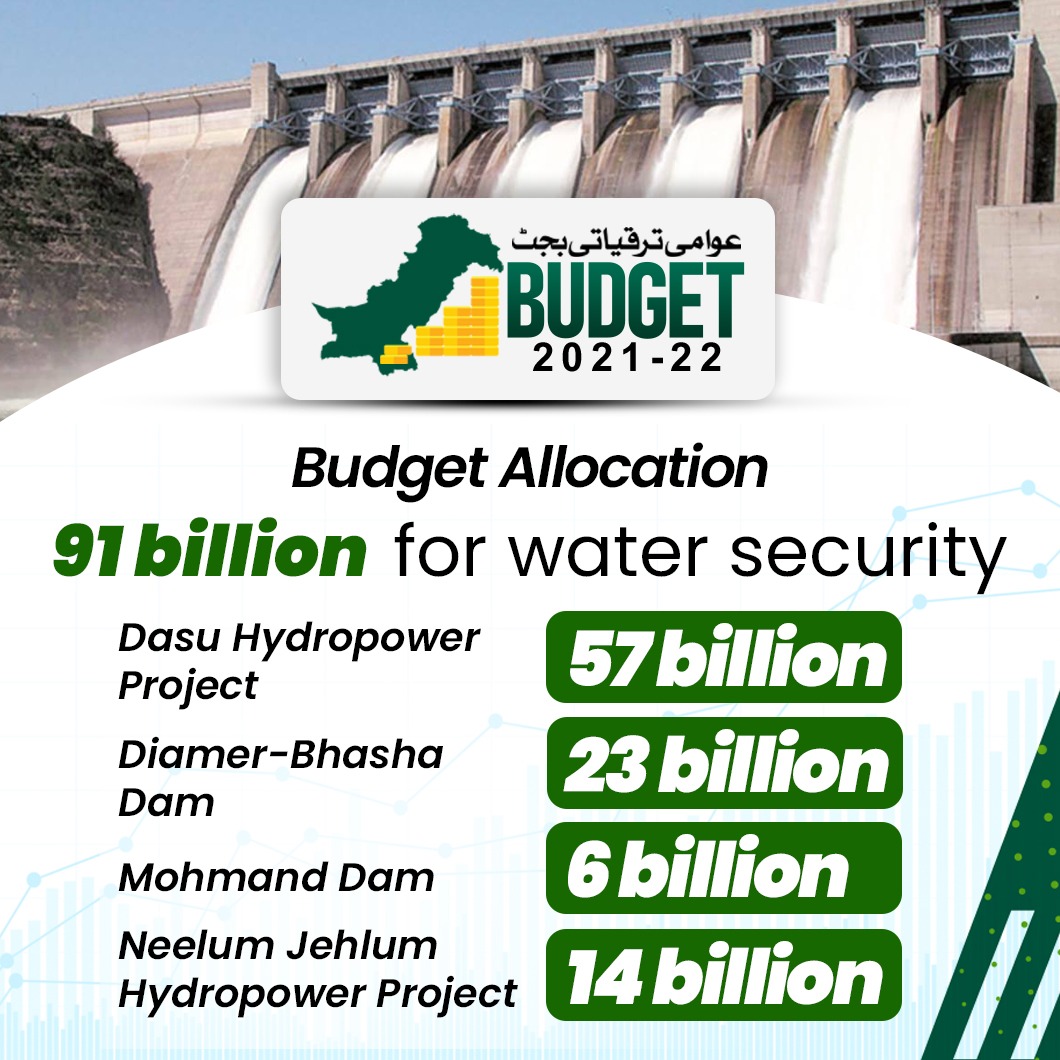

Pakistan has announced Rs8.4 trillion ($54 billion) budget for the next fiscal year, basing it on an ambitious growth target of 4.5 per cent and tripling spending on public sector development with an election just two years away.

A cross-section of Pakistani business community in the UAE and financial analysts shared their candid views with Gulf Today, adding that the budget is poor-friendly and growth focused.

Shan Saeed, Chief Economist at Juwai IQI, told Gulf Today that in his opinion, it is a very pragmatic budget taking all the variables into account and the global economic fragilities in the region. It’s a people centric budget i-e the biggest stakeholder of the country, Pakistani people. Imran deserves applause for focusing on lifting the masses and providing them better standard of living.

“The strategic intent of the budget is growth focused, confidence driven and people centric budget. If Pakistan can achieve a GDP growth rate between 4.5% and 5% by June -2022, Pakistan’s economy is heading for take off stage. Macroeconomic stability is vital for growth outlook of Pakistan.”

“Pakistan has the resilience to make a turnaround and heads north in the coming years. Pakistan can easily achieve the growth target of 5% provided macroeconomic stability remains solid which is going to bolster the economic progression at the macro level. Epitome of the budget is simple: Its very realistic and pragmatic to attain next year.”

“The question is: how soon Pakistan goes into take off phase.” Shan concluded.

Usman Alam, Partner - Assurance & Compliance at ATHGadlang commented that the budget is totally growth-oriented. This budget provides a boost to the economy at a much-needed time when businesses and industries are opening up after a prolonged COVID19 related slump in activity.

Usman further commented that the budget aims to incentivize several sectors including construction with the inclusion of a Rs33b subsidy for low-cost housing schemes. This would provide a multipronged benefit to the population and the construction industry. Usman noted that one of the most ambitious schemes in the budget was the target to provide every citizen with a Sehat Card meant to cover medical expenses up to Rs1,000,000. This would not only provide health care to those that require it the most, it will also boost the health sector.

Other budget related positives include reduction of Capital Gains Tax from 15% to 12.5% for investors on the Active Tax List. Usman added that this would widen the tax net for future boosting the inflow of revenue. Other sectors that would benefit from the budget include the automobile sector with the abolishment of FED on small cars as well as Electric Vehicles.

Shahrukh Zohaib, Managing Partner, ACE Luxury Immigration Solutions, Dubai, said that the Pakistan budget for the year 2021-2022 is marching towards Naya Pakistan with subsidies and incentives for big businesses, manufacturing, corporate market and agriculture sectors. The government has touched base on all stakeholders. Overall, the budget is inclusive and sustainable.

“Inclusiveness is reflected in encouraging small businesses such as Rs500,000 interest-free business loan to every household, Rs250,000 interest-free farming loan and Rs200,000 interest-free loan for tractors and machineries and Rs2 million worth of low-interest loan for house building.”

“Pakistan has allocated $1.1 billion (Rs170 billion) for procuring COVID-19 vaccines, setting a target of inoculating 100 million of the country’s 220 million people by mid-2022 and 4.8 GDP growth in 2022.”

Major Highlights: Tax revenue collection target sets at Rs 5829 billion.

Government expects increase in income tax collection by 7% to Rs 2171 billion.

Contribution of direct tax stands around 37%

Government expects rise in customs duties collection by 23% to Rs 785 billion.

Sales tax collection to rise by 30% to Rs 2506 billion in FY22. Government expects drop in FED by 1% to Rs 356 billion.

Government expects rise in petroleum levy by 36% to Rs 610 billion . Subsidies for new fiscal year would be more than doubled to Rs 682 billion.

Power sector get subsidy of Rs 596 billion compared with Rs 139 billion of FY21.

Wapda to get Rs 245 billion, Kelectric Rs 85 billion and IPPs Rs 265 billion.

Utility stores to get Rs 6 billion, double from FY21. Wheat subsidy for Gilgilt Baltistan increased to Rs 8 billion from Rs 6 billion.

Allocation of Rs 30 billion has been proposed for Naya Pakistan.