Pakistan’s stocks rise to its highest in more than 6 years

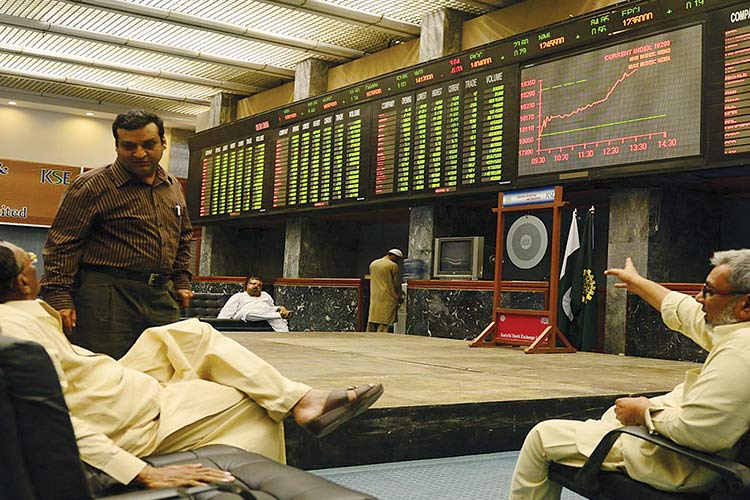

Picture used for illustrative purpose only.

Pakistan will vote on Feb.8, an election commission spokesman said on Thursday, giving investors hope that some political stability and less economic uncertainty will follow once a new government is formed.

The vote initially had been expected to have taken place by early November, and a caretaker government was installed in mid-August to run the country until the next government emerged from the election.

The benchmark stock index struck a record intra-day high of 53,263.07 on Friday, rising 1.15 per cent from Thursday close, before settling back slightly. It was the highest since May 25, 2017.

Despite Pakistan’s economic difficulties the index has gained more than 30 per cent this year, with a turnaround in fortunes coming after the International Monetary Fund (IMF) approved a $3 billion loan programme in July to avert a sovereign debt default.

The share market recovery has a long way to go. Adnan Sheikh, an independent economist, said the market capitalisation was around $27 billion, having been about $100 billion in 2017.

He said the steep depreciation of the Pakistan rupee, as the country slid into a balance of payments crisis, was largely to blame for the drop in market cap.

“The market in dollar terms is still undervalued. The KSE100 index is at around 20,000 points if compared to the dollar value in 2017,” Sheikh said.

Investors also took heart from the arrival of an IMF team in Pakistan for talks on the release of the next tranche of around $700 million by December.

“We are in compliance with the IMF structural benchmarks for this review,” said Shahbaz Ashraf, Chief Investment Officer at FRIM Ventures, a Karachi-based investment company.

Ashraf said that a successful IMF review will help bring external inflows vital for disinflation and stability in the rupee, which recovered from record lows in September.

Investors expect an imminent cut in the central bank’s policy interest rate, currently set at a record high 22 per cent, as inflation appears to have peaked, having slowed to 26.9 per cent year-on year in October. While price pressures may be easing Pakistan’s other economic problems persist - low economic growth, weak exports, high interest payments on debt, and the constant need to manage precious foreign exchange reserves.

Meanwhile Pakistan’s consumer inflation in October was 26.9 per cent year-on-year (y-o-y) compared with 31.4 per cent in September, statistics bureau data showed, as it awaits its first review following a loan from the International Monetary Fund (IMF).

Pakistan is embarking on a tricky path to economic recovery under a caretaker government after a $3 billion loan programme approved by the IMF in July averted a sovereign debt default, but with conditions that complicated efforts to rein in inflation.

On a month-on-month basis, inflation climbed to 1.08 per cent in October, compared with an increase of 2 per cent in September.

This brings the average inflation rate for the fiscal year (July-Oct) to 28.48 per cent, against a target of 21 per cent for this fiscal year. Inflation has been in double digits since November 2021.

Reforms required for the IMF bailout, including an easing of import restrictions and a demand that subsidies be removed, have already fuelled annual inflation, which rose to a record 38.0 per cent in May. Interest rates have also risen to their highest at 22 per cent.

However, some respite came in the form of fuel price cuts and a price-control mechanism announced in October, that caretaker Prime Minister Anwaar ul Haq Kakar said would limit inflation.

Pakistan is being governed by a caretaker administration in the run-up to a general election expected in January.

Analysts say inflation has come down because of lower domestic food and fuel prices and a stronger rupee.

“On a month on month basis, inflation has slowed down to 1.08 per cent versus the last three months averaging 2.4 per cent,” said Mohammad Sohail, CEO of Topline Securities.

Economic analyst Adnan Sheikh said: “Going forward, risks will persist regarding international oil prices amid Middle East tensions along with balance of payment management.”

Meanwhile Pakistan’s central bank kept its key interest rate unchanged at 22 per cent, in line with market expectations, after its policy review on Monday.

The decision comes ahead of a visit by a delegation of the International Monetary Fund that will review progress on targets set in a $3 billion programme approved in July to bail out the struggling economy.